Nine Ways Supply Chains Will Get Stronger in 2021

There’s no doubt that 2020 was a year that exposed end-to-end weaknesses in the electronics industry supply chain and taught many valuable lessons. Now, it looks like 2021 will be a year of figuring out how to put all those lessons into practice.

This past year, of course, was marked by the COVID-19 pandemic, which brought supply chain deficiencies into stark relief, including the need for improvements in supply chain technologies and practices, and more personnel training. Meanwhile, forest fires and myriad natural disasters across the globe caused additional strain that created conversation around supply chain sustainability. Tariffs and geo-political changes shifted the manufacturing partnership landscape and started dialog about shifting manufacturing closer to the end customer. Finally, supply chain security flaws placed a number of organizations in the headlines.

In the face of all this, I’ve identified nine trends on the horizon which, should they play out as I expect, should lay the groundwork for supply chain integrity, stability, and growth into the foreseeable future.

Nine paths to supply chain stability

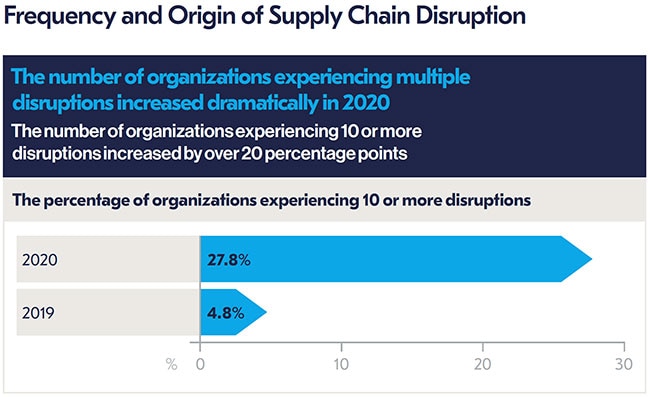

Resilience: In the past, organizations talked about supply chain resilience, but few did all the work necessary to avoid disruptions and recover operational capabilities after those disruptions. Over time, supply chains have grown more complex, global, and interconnected, making these tasks both more difficult and more critical. Meanwhile, nearly every supply chain experienced disruptions last year (Figure 1)1.

Figure 1: Every year brings supply chain disruption, but last year the number of supply chain challenges soared. (Image source: The Business Continuity Institute)

Figure 1: Every year brings supply chain disruption, but last year the number of supply chain challenges soared. (Image source: The Business Continuity Institute)

Focusing on supply chain resilience combined with risk prevention enables companies to mitigate adverse events faster than the competition to serve customers better and stand out in the market. Rather than getting an organization ahead of the pack, supply chain resilience has become a make or break hallmark of survival.

Transparency: The electronics industry has strived for transparency in the supply chain over the last decade. For example, the Dodd-Frank Act included a requirement for public companies to report the use of some metals including tin, tantalum, tungsten, and gold from conflict zones such as the Democratic Republic of the Congo (DRC) to minimize support for forced labor and other human rights abuses. Since that Act, transparency has become required end-to-end, from the deepest tiers of suppliers all the way to end customers. These customers, including consumers, are looking closely at the activities of the companies from which they purchase their products and are demanding higher ethical standards and greater visibility into the organization and its supply chain. That trend will only continue.

Digitization: Knowledge is power and information technology tools are critical to collecting and acting on intelligence. The technology industry has reached a tipping point with organizations spending more time and money to leverage IT tools to make better sourcing, spending, and logistics decisions.

Analytics and analysis tools will harvest supply chain data that will improve decision-making. Artificial intelligence will mitigate the risk of human errors and find patterns in data that will predict demand, eliminate redundancy, and optimize inventory levels. Sensors, which are becoming increasingly affordable and more easily connected, will become standard fare in vehicles and warehouses to improve inventory management, production, security, logistics, and predictive maintenance. Rather than a chance to get ahead of the competition, these technologies will become table stakes to achieve the efficiency, visibility, quality, and profitability to remain competitive.

Sustainability: The ethical and ecological expectations of consumers will drive supply chains to determine how they source, produce, and serve their products in sustainable, eco-friendly, and profitable ways. And the numbers are already showing this to be the case. According to Core Logistics, 84% of consumers report being more likely to purchase sustainable brands and 61% are willing to wait for delivery if it reduces environmental impact.2 OEMs, meanwhile, are leveraging the supply chain to address potential price increases, as well as quality and availability issues associated with these efforts. Three out of the top four sustainability-focused industries, including automotive, industrial goods, and technology, are large users of electronics components.

E-commerce: Customer preferences and demands are likely to inform supply chain strategies in the coming year and beyond. The past year has pushed even reluctant consumers to shop online—and electronics OEMs are rethinking last-mile delivery to allow consumers more flexibility. How and where they pick up or receive their product purchases is just one example of this flexibility. This shift will encourage manufacturers to rethink distribution and transportation strategies to optimize logistics.

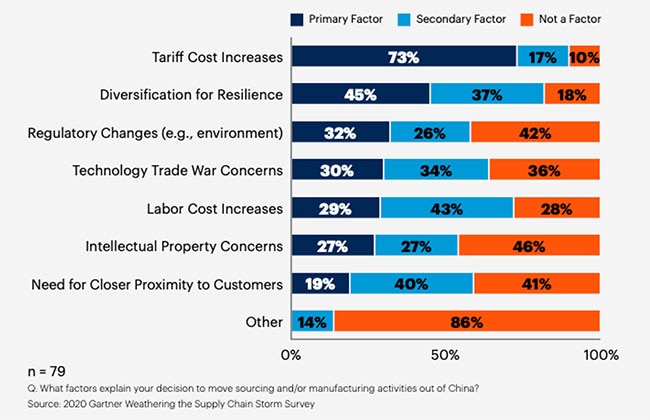

Re-shoring: For sure, “Made in the USA” is more common in the electronics industry, and while it won’t take over, it will be increasingly the case. In recent decades, China, along with other Asia-Pacific countries, has attracted electronics manufacturers due to its close proximity to component supplies, lower-cost labor, and other incentives. Now, however, many organizations are contemplating bringing manufacturing closer to home. “Globalization—the spread of products, technology, information, and jobs across national borders and cultures—has been a dominant business model for many decades, creating complex value chains that span the world,” Gartner said in an April 2021 research report. “But within the globalization context, one element—the operational focus of supply chains—is shifting toward more regional models and changing how companies and nations trade with each other.” About 64% are re-shoring or near-shoring production, the report found.

Figure 2: Tariffs and higher resiliency top the list of reasons why electronics OEMs are considering moving sourcing and/or manufacturing activities out of China. (Image source: Gartner)

Figure 2: Tariffs and higher resiliency top the list of reasons why electronics OEMs are considering moving sourcing and/or manufacturing activities out of China. (Image source: Gartner)

3D printing: Although not technically a supply chain technology, 3D printing can allow manufacturers to replace parts in their machinery and allows OEMs to customize products for end customers or manufacture smaller product runs. Last year gave organizations a glimpse of how 3D printing technology can be used to alleviate—or at least temporarily reduce—strain on the supply chain during demand surges and supply shortages. Over the next three to five years, I believe 3D printing will be ready to handle high-volume production scenarios: That’s going to be a game-changer.

Cybersecurity: Hackers are targeting supply chains as a way of causing disastrous disruptions, as a way to drain valuable data out of the organization, or for straight-up extortion purposes. The recent Colonial Pipeline shutdown is but one example. It’s clear that the explosion of supply chain data brings with it concern around security. Social engineering, ransomware, and other exploits are being aimed at the supply chain and organizations are coming to understand the critical nature of the supply chain network.

I’m optimistic about the application of Blockchain technology here. This has typically been used in the finance world but has promising supply chain applications in terms of security, transparency, and accountability. In an American Productivity and Quality Center (APQC) 2020 poll, familiarity with the technology increased (80% compared to 66% the prior year), with 48% of respondents saying their organization would probably or definitely invest in blockchain in the next two years (vs 23% in 2019).4

Skills gap: Recent months have shifted our understanding of what talents the supply chain worker of the future will need. All of the shifts discussed above add to the list of must-have skills. At the same time, universities used the past year to delve even more deeply into distance learning. Perhaps supply chain workers will return to the classroom (at least digitally) to pick up more training. At the same time, the industry needs to continue recruiting at the undergrad and even high school levels to attract young talent with expertise in key fields, including analytics, logistics, procurement processing, and more. Like all organizations, the focus needs to be on hiring and retaining increasingly diverse talent.

I recall a time when the supply chain function had trouble getting a seat at the table. That has changed as electronics OEMs have come to recognize the supply chain as a strategic function. The past year in particular has ratcheted up awareness about the critical and strategic nature of the function while spotlighting the enormous cost of missteps. Now, OEMs are more likely to invest the time and money necessary to maximize supply chain functionality.

However, success will depend upon the degree to which they adopt the right technologies, hire and train the right talent, and follow best practices. These are deeply interconnected. New technologies are making true transparency and resiliency possible. Efforts to nearshore are shifting sourcing decisions, and the increasing understanding of the strategic nature of the supply chain is drawing the attention of cybercriminals. Whichever way you slice it, 2021 is going to be an interesting year for the supply chain—and it’s only going to get more fascinating from there.

References:

1: Business Continuity Institute, “Supply Chain Resilience Report 2021”

2: Core Logistics, “Supply Chain Sustainability Research Study”

https://resources.coyote.com/coyote-default/supply-chain-sustainability-research-study

3: Gartner, “Are We Navigating a Less Global World?”

4: APQC, “Blockchain Adoption in Supply Chain: Current State for 2020”

Have questions or comments? Continue the conversation on TechForum, DigiKey's online community and technical resource.

Visit TechForum